Figuring estimating your monthly installments for a balloon loan can be tricky. A balloon loan payment estimator is a handy tool that helps you forecast those expenses based on the loan amount, interest rate, and timeframe.

- By inputting these parameters, you can get a precise picture of your monthly expenses.

- Such an estimator can be particularly helpful if you're researching a balloon loan option and want to understand the financial effects.

Several online balloon loan payment estimators are available and straightforward. Just search "balloon loan payment estimator" on the web.

Calculate Your Balloon Mortgage Payment

Figuring out your monthly contributions for a balloon mortgage can seem challenging. It's essential to grasp how this type of loan works before you commit to it. A balloon mortgage has lower initial expenses, but your final payment is significantly larger than your regular monthly dues. To accurately calculate your balloon mortgage payment, you'll need to consider the principal amount, the interest rate, and the loan term.

- Many online calculators can help streamline this process.

- Don't forget to include any extra fees or costs into your calculations.

- Ensure you can comfortably afford the balloon payment at the end of the loan term.

Calculating Balloon Payments Simply

Figuring out how much a balloon payment will be can seem daunting. Luckily, there are methods available to simplify the process. A simple balloon payment calculator is a useful instrument that can provide you an accurate estimate of your future payment. These calculators typically require information such as the initial loan amount, the interest rate, the loan term, and the payment made over the life of the loan. By adding this data, you can quickly calculate the size of your balloon payment at the end of the loan period.

- Think about the factors influencing your balloon payment, such as interest rates and market fluctuations.

- Use a balloon payment calculator to get a clear picture of your future financial obligations.

A Balloon Mortgage Amortization Calculator

A balloon mortgage is a unique type of loan where monthly payments reduced payments for a determined period. At the termination of this term, you're required to make the unpaid loan amount. This can lead to a large payment due, hence the "balloon" analogy.

To comprehend the potential effects of a balloon mortgage, an amortization calculator becomes invaluable. It allows you to forecast your monthly payments read more over the span of the loan and see the significant balloon payment at the end.

- Employing a balloon mortgage amortization calculator can help you develop strategic financial decisions. It provides you with a comprehensive understanding of your future debt obligations.

- These calculators are easily accessible online. Simply provide the loan amount, interest rate, and loan term, and the calculator will generate a clear breakdown of your monthly payments.

Comprehend Balloon Loans: Calculate Payments

Balloon loans can seem like a tempting solution, offering lower monthly payments initially. However, these loans come with a significant catch at the end of the term: a large lump-sum payment that can be challenging to afford. Understanding how balloon loan payments work is crucial before you sign on the dotted line to one.

To determine your monthly payments, you'll need to know the amount, interest rate, and term length. Many online tools can help with this process. Be sure to include all charges associated with the loan, as these can affect your overall price.

- Make sure you understand the terms of your balloon loan agreement before you sign it.

- Plan for the large balloon payment at the end of the term.

- Consider alternative loan options that may better suit your financial needs.

Craft a Balloon Payment through Our Tool

Thinking about structuring your loan with a balloon payment? It's crucial to appreciate the effects it could have on your finances. Our easy-to-use balloon payment calculator helps you visualize potential outcomes based on different terms. Just enter your financing figures, and our software will generate a in-depth report.

Jaleel White Then & Now!

Jaleel White Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Richard Thomas Then & Now!

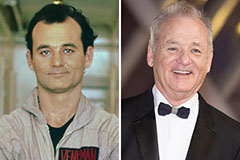

Richard Thomas Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!